Who We Are

Since 1982, Hamilton Insurance Agency has been a leading authority in providing comprehensive insurance products, risk management services, integrated benefits administration and relevant technology solutions. Our experience over the last four decades has solidified us as one of the nation’s largest independent insurance brokerage firms, specializing in senior housing and long- term care facilities.

By leveraging longstanding relationships with lenders and carriers, we are able to craft tailored insurance programs for our clients at economical costs. In order to achieve the ultimate goal of protecting your bottom line, we proactively assess risk and implement solutions through our industry-leading proprietary technology.

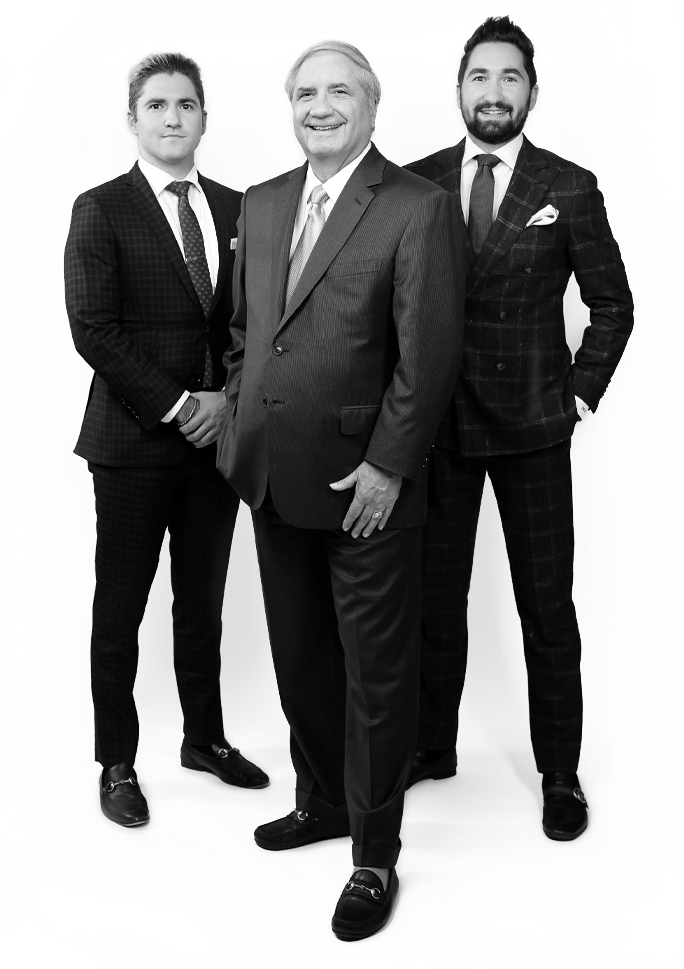

Family-Owned Firm with Corporate Capabilities

Hamilton’s operating philosophy is grounded in personal relationships, as evidenced by founder Alan J. Zuccari’s leadership. Unlike most large brokerage shops, our clients are guaranteed unfettered access to Hamilton’s executive team. Together with his two sons, Jason and Jarred Zuccari, Keith Parnell and their senior executive team, Alan J. Zuccari has led HIA to become a leading authority in providing comprehensive insurance and risk management services.

The organization is comprised of 100 employees in divisions spanning Life, Health and Benefits, Commercial Property and Casualty, Personal Lines, Accounting, Risk Management, Claims and Wholesale.

The Hamilton Insurance Advantage

Why choose Hamilton for your business?

Client needs are Hamilton’s priority. By educating ourselves on the complexities of your business, from current challenges to long-term goals, we will position ourselves to be an extension of your team. With more than 40 years of experience in the insurance industry, the choice is simple.

Advise healthcare clients across the country ranging from small, stand-alone community entities to national operators with hundreds of facilities under their portfolio.

Thorough, upfront analysis to familiarize ourselves with client operations, surrounding community, residents and staff.

Technology developed and supported in-house allows us to customize our suite of tools to align with client needs.

Tailored insurance program generation.

Ability to harness longstanding carrier relationships for negotiating leverage.

Strong relationships with insurers for reinsurance.